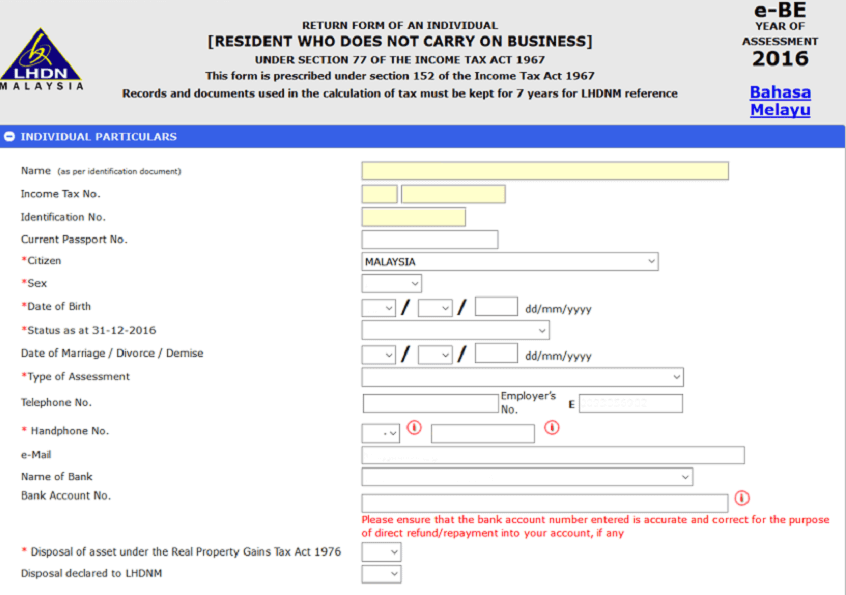

Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual filing. Melayu Malaysia MYTAX Content.

Ea Form 2021 2020 And E Form Cp8d Guide And Download

E - Janji Temu.

. Double check all the EA forms to ensure that everything is in place. With the below simple steps you can download the EA form in Deskera People. Select Generate EA for 2020 from the drop-down menu.

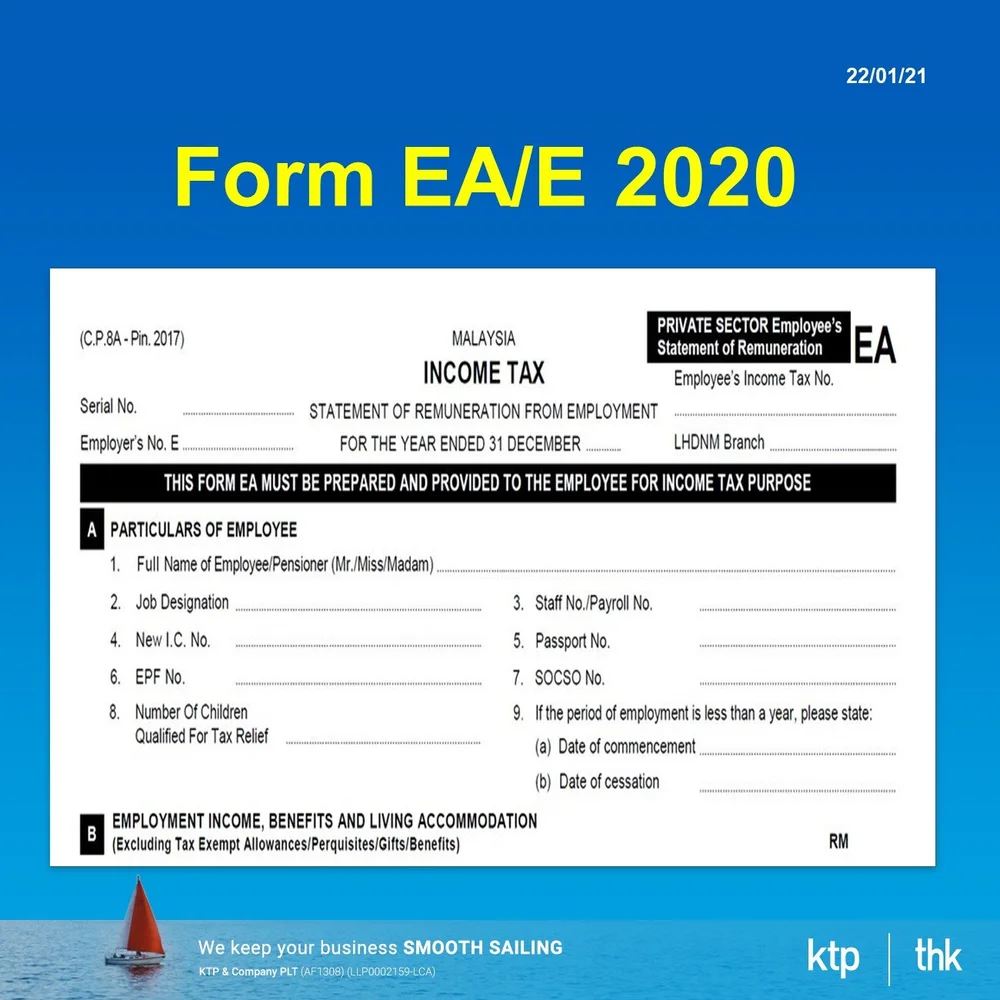

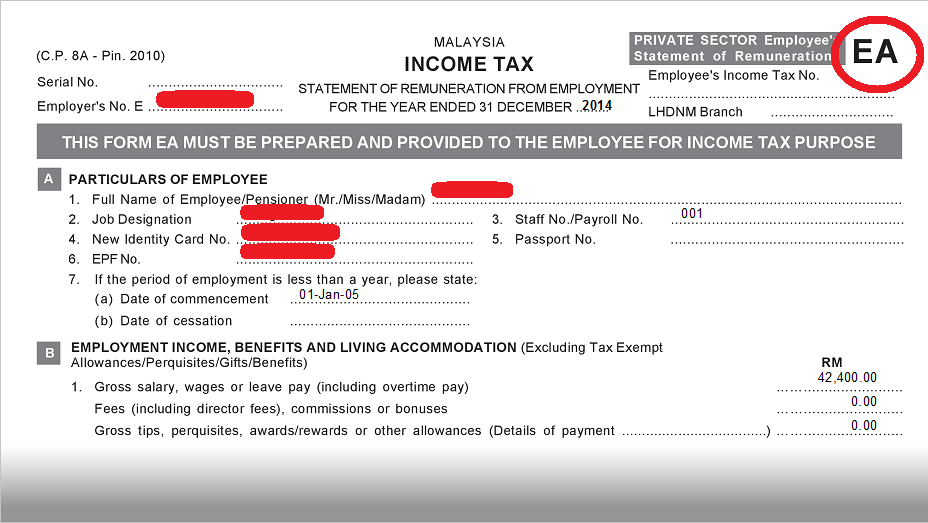

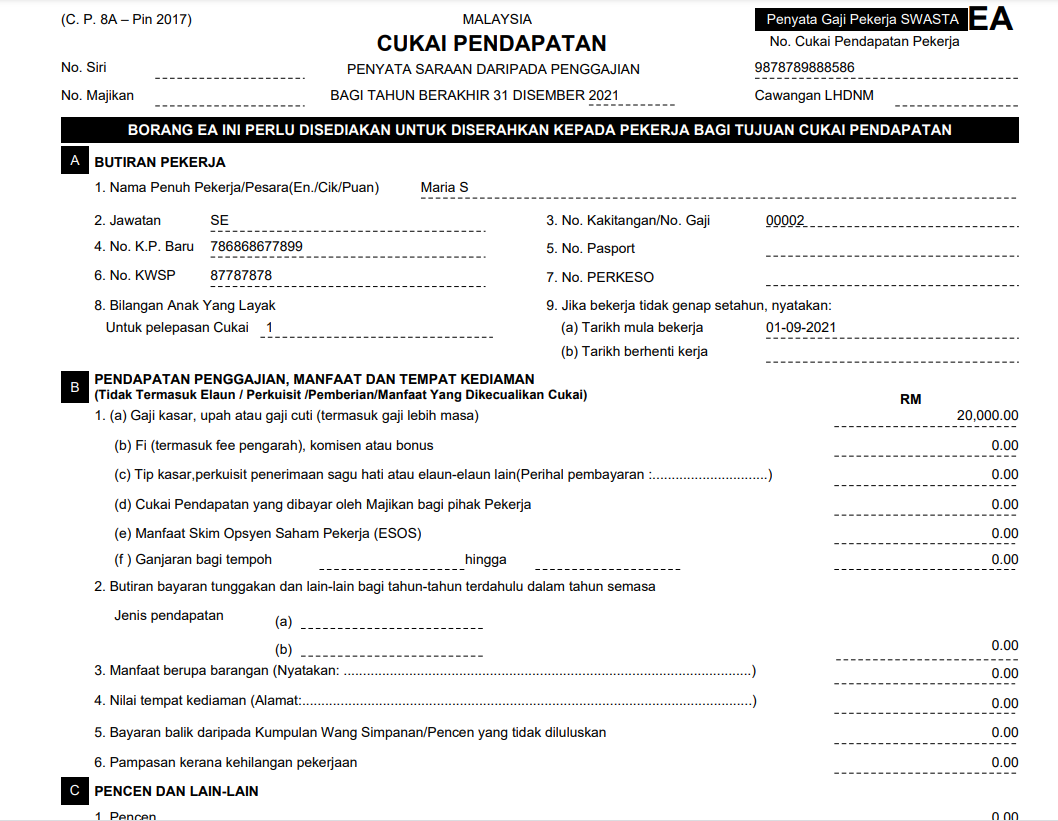

An EA form is a report of employees salaries and statutory contributions paid for the past year. Do it in Feb so they can have their tax assessment in March. In accordance with subsection 83 1A of the Income Tax Act 1967 ITA 1967 the Form CP8A must be prepared and rendered to the employees on or before 28 February to enable them to.

Every employer must provide his employee with their EA Form by the last day of February. According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year. What is Form E.

Form EA is an annual income statement prepared by a company for employees tax submission purposes. Have you prepared the Form EA for Employees. 5 minutes Editors Note.

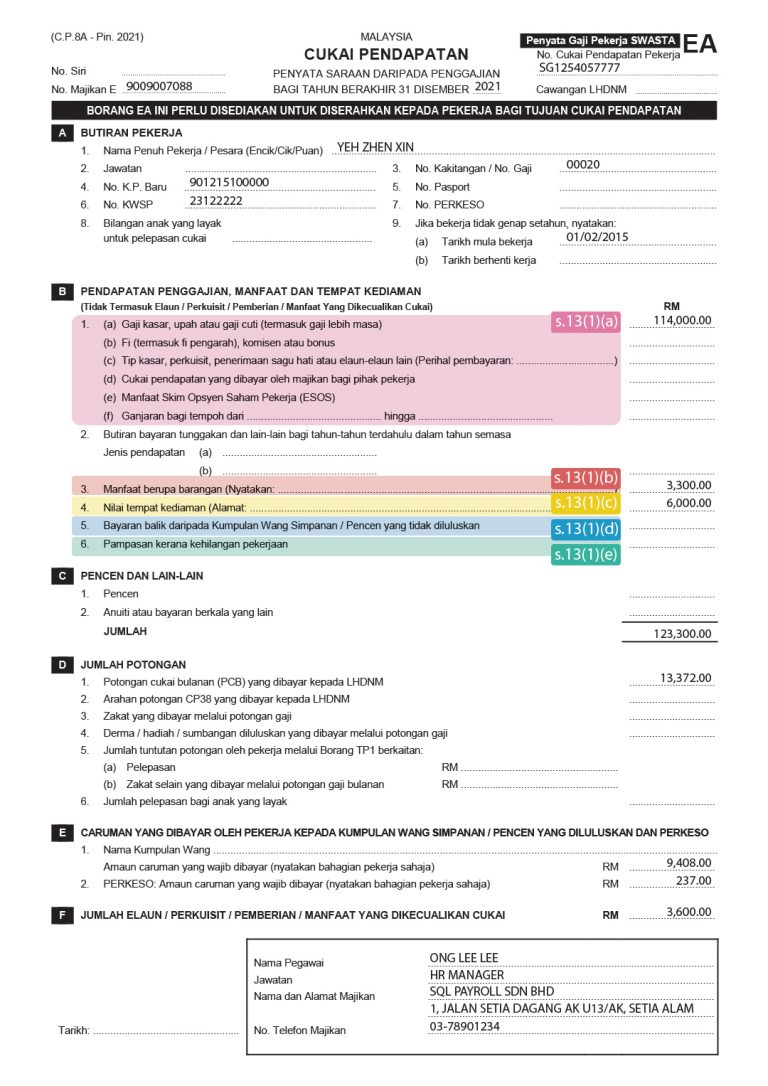

2021 MALAYSIA INCOME TAX STATEMENT OF REMUNERATION FROM EMPLOYMENT FOR THE YEAR ENDED31 DECEMBER Serial No. Correct answer 08022022 By Stephanie Jordan Blog Navigate to Payroll Payroll Settings Employee Assistance Program. Form E CP8D You may now send EA form to your colleagues by email or by print out the hardcopy.

To prepare EA forms to print for employees e-Filing you can refer to the guide below or follow these steps. Go to Reports ModuleUnder Yearly FormsSelect EA Form 2. What is Form EAEC.

Each company will issue a separate EA form so if you have worked for more than one company in one year you will have to have an individual EA form for each. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. In Part F of Form EA you could file for certain tax exemptions that can reduce your overall chargeable.

Go to PayrollFormsForm E. It is because these price differences are viewed as perquisites under Section 13. THIS FORM EA MUST BE PREPARED AND PROVIDED TO THE EMPLOYEE FOR INCOME TAX PURPOSE A B C E CONTRIBUTIONS PAID BY EMPLOYEE TO APPROVED PARTICULARS OF EMPLOYEE EMPLOYMENT INCOME BENEFITS AND LIVING ACCOMMODATION Excluding Tax Exempt AllowancesPerquisitesGiftsBenefitsRM PENSION AND OTHERS TOTAL.

We will show you how to fill up your tax form if you have more than one EA form later in the guide. July 7th 2020 No Comments. According to the Inland Revenue Board of Malaysia an EA Form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that.

Double-check all of the EA paperwork to make sure that everything is in order before moving further. Form E is a declaration report required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. Failure to submit will result in a fine of up to RM 20000 andor up to 6 months imprisonment.

According to the Income Tax 1967 ITA 1967 Form EA must be given to the employees before 28th of February. However Bryan is liable to declare income tax on the price differences that had been granted to him for the purchase of MEGA shares under ESOS. As a business in Malaysia youll want to avoid a fine of RM 200 RM 20000 andor a maximum of 6-month imprisonment term under the Income Tax Act Section 1201b.

In Deskera People you can easily be able to download your employee EA form. THIS FORM EA MUST BE PREPARED AND PROVIDED TO THE EMPLOYEE FOR INCOME TAX PURPOSE CP8A - Pin. This article was published in Feb 2020 and updated in Jan 2022.

Click on Generate EA for 2020. The EA form is a Yearly Remuneration Statement that includes your salary for the past year. Once that is done click on Download EA Forms sign and pass them to your employees.

In Part F of Form EA you can file for tax exemptions for certain benefits-in-kind that can reduce your. What is Form EA. Select the year from drop-down menu for which you need to download the EA form.

What if you fail to submit Form E. E PRIVATE SECTOR Employees EA Employees Income Tax No. Furthermore youll want to ensure that you file the form online.

Head over to Payroll Payroll Settings EA. Who need to file the Form E. EA Form Borang CP8A What is EA Form In accordance with subsection 83 1A of the Income Tax Act 1967 ITA 1967 the Form CP8A CP8C must be prepared and rendered to the employees on or before end of February the following year to enable them to complete and submit their respective Return Form within the stipulated period.

The following information are required to. How To Get Ea Form Malaysia. LHDN already opened the actual Form E submission CP8D it should be very straightforward and work exactly like last year.

EA Form and CP8D forms are available in both English and Malay versions but the Excel versions are only available in English. A below screen will appear Year. For first time ezHasil users youll need to click on First Time Login.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing. You will need to refer to this to file personal taxes during. The deadline for 2020 is the 28th of February 2021.

Understanding Lhdn Form Ea Form E And Form Cp8d

Freelance Account Services Home Facebook

Ea Form 2021 2020 And E Form Cp8d Guide And Download

Malaysia Payroll Reports And Payslips For Easy Monthly Payroll

Form St Partners Plt Chartered Accountants Malaysia Facebook

Understanding Lhdn Form Ea Form E And Form Cp8d

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Ea Form Sample Image From Actpayroll Com Cilisos Current Issues Tambah Pedas

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Ctos Lhdn E Filing Guide For Clueless Employees

Ini Kisahku Suka Duka Bersama Insan Insan Tersayang Pssstt Korang Dah Dapat Borang Ea

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Malaysia Payroll Compliance How To Generate Ea Form In Deskera People

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

Understanding Of Ea Form Clpc Group